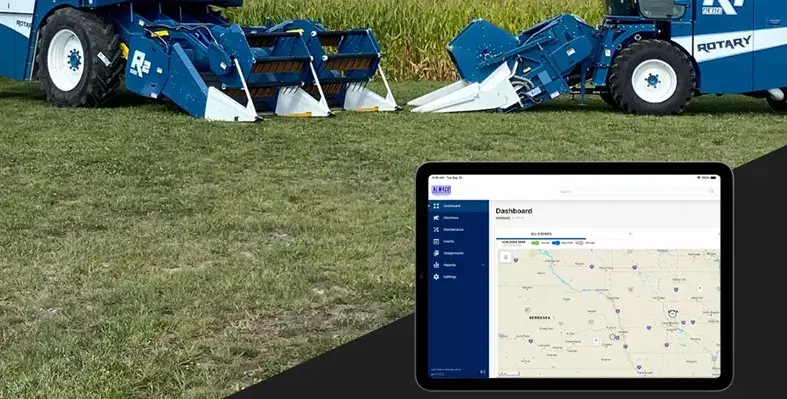

Moisture control is a key factor in ensuring the final feed is palatable, retains its nutrients, and is consistent. (Image source: Hydronix))

One of the big challenges in the animal feed industry is the number of different formulations that can be produced by a single plant

For each batch, it is essential to ensure that the quality of the product is correct so that the animals are fed a balanced nutritional diet optimised for their type and stage of development. For this reason, moisture sensors are often used in conjunction with a control system that manages the formulation parameters. Controlling and measuring the moisture enables the correct calibration for each of the different formulations.

Moisture control is a key factor in ensuring the final feed is palatable, retains its nutrients, and is consistent. Benefits of this include:

• Improved nutritional consistency

• Reduced spoilage and waste

• Improved shelf life

• Optimised pellet durability

• Increased plant efficiency

• Reduced process downtime

Where to measure moisture

Effective moisture control of the entire process requires the installation of online moisture measurement sensors in several different positions:

1. Measurement between raw intake and storage silos allows unsuitable incoming materials to be managed.

2. Ensures raw materials are correctly proportioned, compensating for varying moisture levels in stored material.

3. Drying or Conditioning may be necessary in hot and/or wet climates to increase the moisture of materials for milling, as dry material increases breakage and dust.

4. Measurement in the mixer allows the addition of water to ensure material is sent for conditioning and extrusion/pelleting.

5. The measurement at the input of a dryer can be used as a process variable for feed-forward control.

6. Measuring at the output of a dryer enables feedback control from the setpoint error.

7. Measuring at output of cooler prior to packing/storage allows control of cooler parameters and a final quality control check prior to storage.

The Hydro-Mix XT sensor is recommended to be installed in the mixer end wall to ensure the mix has the correct moisture, is mixed homogeneously, and is ready for the next process stage.

Animal feed comes in all shapes and sizes and has many different formulations. Moisture measurement is a vital element of the plant to ensure the efficiency of the process and provides precise process variables to the control system that can use stored calibration data for different formulations. Moisture measurement is also important for a quality controller to ensure the feed is palatable, retains its nutritional value and has a suitable shelf life.

Read the full story at https://hubs.li/Q03jRlZc0