In The Spotlight

The Inhouse Farming Feed and Food Show 2026 is gathering pace as exhibitor registration opens ahead of its return to EuroTier 2026 in Hanover, Germany.

Taking place from 10 to 13 November 2026, the show will once again form part of EuroTier, recognised globally as the leading exhibition for professional animal farming and livestock management. Organised by DLG, the event continues to strengthen its position as a central meeting point for forward thinking businesses shaping the future of agriculture and food production.

Interest is already building across the sector. Companies working in vertical farming, controlled environment agriculture, alternative protein development, aquaculture, fermentation and smart farming technologies have confirmed their participation. The show provides a practical link between agricultural production and modern food systems, bringing together expertise, innovation and commercial opportunity under one roof.

Running alongside EuroTier, the platform also complements EnergyDecentral, which focuses on decentralised energy solutions. Together, the exhibitions explore how farming, food production and energy systems can connect more efficiently. A strong emphasis will be placed on circular thinking, with many exhibitors presenting concepts that reuse side streams to create additional raw materials. The aim is to develop closed loop systems that are cost effective and resource conscious across the entire value chain.

The 2026 edition will highlight technologies ranging from insect farming and aquaculture systems to bioreactors for fungi and microalgae. Advances in cellular agriculture and innovative inhouse farming methods will also feature prominently. As global demand for reliable and sustainable protein sources grows, organisers expect visitor numbers from overseas to rise further.

Marcus Vagt, Head of Energy, Inhouse Farming and New Foods, DLG, said, “The momentum in the market is enormous. More and more companies are recognizing that inhouse farming is a key component of the food systems of the future. It supports the DLG’s new guiding principle of ‘sustainable productivity growth’, which unites growth and resource conservation. At the same time, inhouse farming enables high product safety because plants and organisms grow in closed, controlled environments – free from climate fluctuations and external influences. This ensures reliable feed and food safety standards."

“Our exhibitors benefit from a highly qualified professional audience, international visibility and an environment that actively promotes innovation. We are delighted with the strong interest already at the start of the registration phase,” Vagt adds.

Following the Hanover exhibition, the Inhouse Farming Feed and Food Convention will take place in Hamburg on 21 and 22 April 2027, continuing the conversation around the future of food and farming.

Broiler chicken prices in several parts of Indonesia have risen as Ramadan 1447 Hijri approaches, with some traditional markets reporting figures above the government’s Reference Purchase Price and Highest Retail Price of US$2.25 per kilogram.

At Serpong Traditional Market, chicken is now selling for US$2.84 per kg. Traders say the increase began last weekend, with prices jumping between US$0.30 and US$2,000 within days. Based on patterns seen in previous years, sellers expect further rises of around US$0.12 every two days, which could push prices to US$2.96per kg if demand continues to strengthen.

In Medan, North Sumatra, broiler chicken is being sold for between US$42,000 and US$45,000 per kg. Economic observer Gunawan Benjamin linked the rise to stronger demand ahead of Ramadan, while supply growth has remained limited.

"Many people are complaining about the price of broiler chicken, which has reached Rp 45,000 per kg. However, in several traditional markets in Medan, prices still vary between Rp 42,000 and Rp 45,000 per kg," Gunawan said.

He noted that supply in the week before Ramadan increased by less than 12 percent compared with the previous week, while demand rose at a faster pace.

In Surabaya, monitoring at Dukuh Kupang Market on February 17, 2026 showed chicken priced at US$42,000 to US$43,000 per kg, slightly above the set retail ceiling. Nationally, data from the National Food Agency recorded the average price at US$40,572 per kg on February 15, 2026, a marginal daily decline.

Trade Minister Budi Santoso stressed that the government is tracking developments closely. "So, that doesn't mean the national average is Rp 45,000 per kg. However, we are still monitoring high prices in some markets. This could be due to insufficient supply or increased demand. We are ensuring prices remain under control and within the benchmark," Budi said.

Head of the National Food Agency, Andi Amran Sulaiman, added that President Prabowo Subianto is directly monitoring food prices. "On several occasions, the President even asked about the development of meat and chicken prices several times a day," said Amran.

As Ramadan gets under way, residents of Polewali Mandar Regency in West Sulawesi can expect steady chicken prices despite earlier concerns about increases.

Local authorities say the situation remains under control and supplies are more than adequate to meet seasonal demand.

Fitriani, Head of the Food Security Division at the Marine and Fisheries Office of Polewali Mandar, confirmed that recent price rises are still within acceptable limits. “There has been an increase, but it is still reasonable and below the Government Reference Price (HAP) set by the government,” she said.

Alongside the Industry and Trade Office and officers from the Criminal Investigation Agency of the Indonesian National Police, she inspected Pasar Sentral Pekkabata to assess the market situation. According to Fitriani, live chickens are currently selling for around Rp70,000 per bird, with an average weight of 2.5 kilograms.

“The current market price per bird is Rp70,000, with an average weight of 2.5 kilograms. That means the price per kilogram is only around Rp28,000. This is not far from the government’s HAP of Rp25,000 per kilogram for live chickens at the producer or farmer level,” she explained.

She added that supplies in Polewali Mandar are secure, with traders holding up to twice their usual stock. The modest price rise is seen as a seasonal trend linked to increased demand before Ramadan, when families traditionally hold thanksgiving gatherings and prepare special meals.

At provincial level, Nur Kadar from the Food Crops, Horticulture, and Livestock Office of West Sulawesi said prices remain stable across the region. Meanwhile, at national level, the Ministry of Agriculture has reaffirmed its commitment to safeguarding both consumers and traders.

“In line with the Minister of Agriculture’s directive, we want to ensure the public obtains products that are safe, healthy, wholesome, and halal at affordable prices, while traders still receive reasonable margins,” said Agung Suganda in Jakarta.

Minister of Agriculture Andi Amran Sulaiman also stressed that ample production and strong stocks should prevent unjustified price hikes. Authorities say monitoring will continue through Eid al Fitr to maintain steady supply and fair pricing.

-

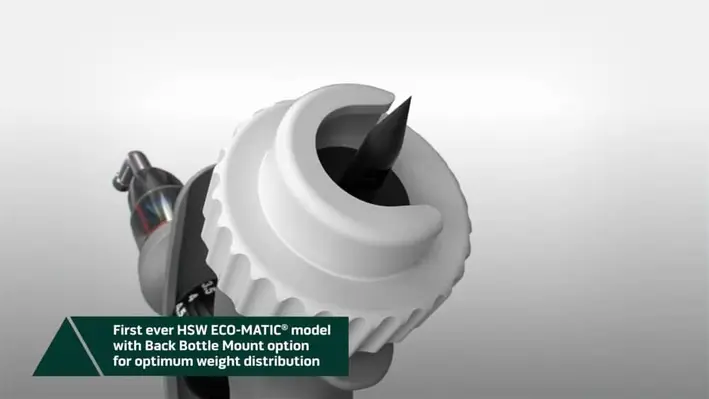

HSW ECO MATIC® 6ml _ 10ml (for injection, oral and pour-on application)

Hyderabad, India

China has emerged as Brazil’s largest supplier of fertilisers, marking a significant shift in the country’s agricultural trade landscape.

According to a report, China overtook Russia for the first time after shipping 9.76 million tonnes of fertilisers to Brazil between January and October 2025.

The main products exported were ammonium sulphate and NP based fertiliser formulations containing nitrogen and phosphorus, both essential nutrients for crop development. During the same period, Russia supplied 9.72 million tonnes, maintaining its position as a key strategic partner in Brazil’s fertiliser market.

The sharp rise in imports from China has, however, placed pressure on Brazil’s port infrastructure. A surge of vessels carrying fertiliser cargo led to extended queues at the Port of Paranagua throughout the year. On average, ships waited nearly 60 days before unloading.

"This backlog created a significant logistical bottleneck, putting pressure on the port's operating capacity and increasing costs and demurrage, which is the fee charged when a container, vessel or cargo remains longer than permitted in a port, terminal or depot," the report quoted.

The congestion has raised concerns among traders and farmers alike, as delays and additional charges can ultimately increase the cost of agricultural production. Efficient fertiliser supply is critical for Brazil, one of the world’s leading agricultural producers, particularly as farmers prepare for major planting seasons.

The report also highlights ongoing challenges in the market. It notes that the exchange ratio between agricultural crops and phosphated fertiliser sources remains unfavourable, meaning farmers are receiving less purchasing power from crop sales when buying fertilisers.

Despite these pressures, fertiliser deliveries across Brazil increased by 9 per cent through August compared with the previous year. Industry analysts suggest that total deliveries could reach a new record in 2025. The state of Rio Grande do Sul is expected to play an important role in shaping the final outcome, largely due to delayed purchasing decisions earlier in the season.

The shift in supplier dynamics reflects broader changes in global trade flows, as Brazil continues to diversify its sources while balancing cost, reliability and long term supply security.

IPEMA Poultry India celebrated a proud achievement at the 12th Kolkata International Poultry Fair 2026, where it was presented with the prestigious Exhibitor Award.

The recognition was conferred by the West Bengal Poultry Federation in association with the Animal Resources Development Department, Government of West Bengal. The honour acknowledged the association’s strong presence and meaningful contribution to the event.

The award was received by the IPEMA Poultry India team led by its President, Uday Singh Bayas, along with team members who have consistently worked to promote and strengthen the poultry sector. The moment marked an important milestone for the association and reflected the collective dedication behind its continued efforts to support the industry.

The recognition at the 12th Kolkata International Poultry Fair underlined the close partnership between IPEMA Poultry India and the West Bengal Poultry Federation. It also highlighted the value of cooperation among industry organisations that share a common aim of advancing India’s poultry sector. Such collaboration plays a vital role in building a stronger and more competitive industry capable of meeting both domestic and international demand.

Events like the Kolkata International Poultry Fair provide an important meeting ground for farmers, producers, technology providers and industry leaders. They encourage dialogue, showcase new ideas and offer insight into the latest developments in poultry farming, feed management, equipment and sustainable practices. The award reflects IPEMA Poultry India’s active engagement in these conversations and its commitment to driving progress.

Looking ahead, the association remains focused on encouraging innovation, supporting knowledge exchange and strengthening relationships across the poultry value chain. This recognition serves as motivation to deepen partnerships with regional and national bodies while continuing to promote responsible and sustainable growth.

The Exhibitor Award stands as a reminder of the trust and shared vision that guide the industry forward. With continued collaboration and commitment, IPEMA Poultry India aims to further enhance India’s position in the global poultry landscape while supporting the long term development of the sector at home.

Limex has unveiled its latest innovation in industrial washing technology with the introduction of the Modular 8, a highly flexible and configurable washing machine platform designed for crates, seed trays, flower buckets and floats.

The new line marks a significant shift towards modular engineering, allowing customers to build exactly the washing solution they need using standardised components rather than costly custom-built systems.

Unlike traditional crate and tray washers that often require extensive engineering work to meet specific customer requirements, the Modular 8 is built from individual modules that connect seamlessly into a single washing line. These include pre-wash units, one or more main wash modules, rinse sections and blow-off units. This modular approach enables users to tailor the system precisely to their operational layout, hygiene standards and processing capacity.

By installing multiple main wash modules in sequence, the system increases soaking time and washing power, delivering higher throughput without compromising cleaning performance. Each standard module also offers multiple configuration options, such as higher-pressure pumps or advanced filtration technologies. The platform supports both left-hand and right-hand configurations, ensuring maximum flexibility for different production environments.

"With the Modular 8, we make it easier to choose exactly the configuration that matches the customer's capacity, hygiene requirements, and budget," says Joep Janssen, owner of Limex. "Our engineers have designed the machines in such a way that they follow each other seamlessly."

With a tunnel width of 800 millimetres, the Modular 8 is suitable for a broad range of applications, including harvest crates, seed trays, flower buckets and DWC floats. The system has also been designed with maintenance efficiency in mind. Improved accessibility of components simplifies cleaning, inspection and servicing, helping to reduce downtime and improve overall operational efficiency.

The Modular 8 builds on Limex’s reputation for proven, high-quality engineering. Constructed from robust stainless steel, the platform delivers durability, reliability and long service life. Twelve Modular 8 lines are already in operation across multiple countries, demonstrating strong market acceptance.

This launch sets the foundation for future developments, with the Modular 10, Modular 14 and Modular 18 planned to follow. These larger, configurable models will eventually replace Limex’s existing cart washers and big box washers, reinforcing the company’s commitment to modular, future-ready industrial washing solutions.

The latest generation of Braud harvesters demonstrates impressive versatility across a wide range of vineyard structures. (Image credit: New Holland)

New Holland Agriculture continues to set new standards in modern viticulture with its acclaimed Braud grape harvester range - a series celebrated globally for precision, productivity and long-lasting reliability.

Built on decades of specialist expertise, the Braud brand has become synonymous with exceptional grape-harvesting performance, and under the New Holland umbrella it remains a trusted partner for winemakers seeking both efficiency and gentle crop handling.

Each Braud harvester reflects a signature blend of engineering excellence and vineyard-friendly design. The machines are created to treat vines with care while delivering powerful harvesting capability, ensuring that grapes are collected cleanly and with minimal damage. This focus on protecting fruit integrity directly enhances vineyard productivity and supports the production of higher-quality wines.

The latest generation of Braud harvesters demonstrates impressive versatility across a wide range of vineyard structures. With both high-capacity and extra-high-capacity models, including the popular 9000 L and 9000 X series, the range adapts effortlessly to narrow boutique vineyards, expansive commercial estates, and even sloped terrain. Their advanced systems such as the industry-proven Noria basket conveying system, optional destemmer technology, and innovative side-conveyor configurations ensure consistently clean, gentle and efficient fruit handling.

This adaptability makes Braud harvesters an ideal choice for growers looking to streamline operations while maintaining strict quality standards. Backed by a global legacy and trusted by thousands of vineyard operators, these machines are built to deliver season after season, reducing labour needs, improving harvest speed, and preserving overall vine health.

Engineered for durability and operator comfort, the Braud range combines robust construction with intuitive controls, offering ease of use without compromising on precision. The result is a harvester that not only boosts productivity but also supports sustainable agricultural practices, helping vineyards reduce waste and optimise long-term output.

Choosing a Braud grape harvester means investing in a heritage of innovation, reliability and world-leading vineyard technology giving growers confidence in every harvest and reinforcing New Holland’s reputation as a champion of next-generation viticulture solutions.